Uranium supply and demand: In for the long haul?

Given the growing excitement regarding the imminent nuclear renaissance, IFandP takes a timely look at the uranium supply situation, which will underpin this vast and increasingly important industry in the years to come.

Unlike other commodities, uranium has essentially just one use: power generation in nuclear reactors. As a result, demand is determined purely by the number of reactors in operation and their capacity factors. It follows that with the exception of new reactor starts, operational news tends towards the bearish, given the economic incentive for keeping capacity factors high and the fact that nuclear reactors are very much a baseload technoloy. The upshot of this is that global uranium demand going forward can be easily extrapolated from new build proposals, projects under construction and decommissioning schedules, over a 5-10 year timeframe. In addition, the small volume of processed fuel means that power utilities purchase uranium in batches. This is one of the main reasons, why uranium hasn’t recorded gains similar to those of other energy commodities on the back of the global economic recovery. In addition, this also suggests that short- to medium-term gains in the absence of new reactor starts will be limited to a few percentage points.

Uranium differs substantially in terms of its supply/demand dynamics to oil, the most studied energy commodity when it comes to depletion. In particular, there is little danger of domestic demand in major uranium-producing nations eating into their capacity to export the fuel abroad. However, as with oil, there is a major drive by developing countries, such as China to lock up the resources needed to continue their break-neck expansion.

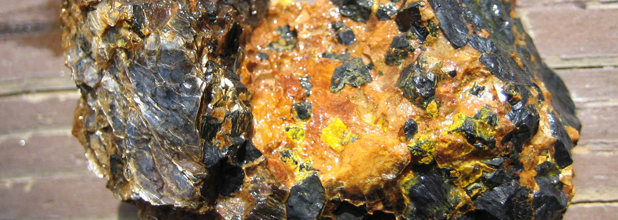

A good example of such a deal is the acquisition of a AUD83.6m controlling stake in Australia’s Energy Metals Ltd (EME.AU) last year. The growth in Chinese demand for yellowcake was highlighted in January, when it imported ~3337t of uranium, over 10 times the amount seen in January 2009. Fifty-seven per cent of the imported uranium came from Kazakhstan, with smaller contributions from Russia, Namibia and Uzbekistan. The country currently has 11 reactors in operation, with a further 20 under construction. However, this pales in comparison with the 36 currently in the planning stages and proposals for a further 157. Small wonder then, that the World Nuclear Association is expecting the country’s nuclear capacity to grow to 60GW by 2020, before reaching 160GW by 2030. For some idea as to how this will impact the uranium market, comments made by Zhou Zhenxing, chairman of Guangdon Nuclear Power’s uranium supply limit made back in November are quite sobering. He predicts that the utility’s annual need for uranium will rise fivefold to 10,000t in 2020, up from the 2000t seen in 2009.

Often overshadowed by China, India’s own efforts in this arena are also impressive and are accelerating courtesy of the Nuclear Suppliers’ Group agreement achieved back in 2008 and the subsequent civil nuclear cooperation agreements with the US, Russia, France, the UK, among others. The country’s nuclear capacity stood at 3.7GW in 2006 and the WNA expects this to rise to 20GW by 2020 and 63GW by 2032. The rapid pace of new build is being driven primarily by a projected 6.3 per cent annual increase in electricity consumption per capita. While China is rapidly expanding its own nuclear expertise so that it can handle all aspects of plant construction and the fuel cycle, India is working hard to develop fast breeder and thorium reactor technology, a sensible strategy given its large thorium reserves, lack of uranium resources and the understandable desire to avoid direct competition with other developing economies, which may potentially have deeper pockets.

- Many countries such as China and Japan are rushing to lock up uranium supplies abroad due to their lack of domestic resources

Japan is also looking to secure uranium supplies. The country lacks any real energy resources of its own and is aiming to build another 13 nuclear reactors. In this light, the current low share price of many uranium miners has been seized upon by Japanese companies, eager to buy up resources at a discount. Late in 2009, Mitsubshi Corp teamed up with Cameco to buy Rio Tinto’s Kintyre Uranium deposit in Western Australia for US$495, and Mitsui & Co bought a 49 per cent stake in the Canadian Uranium miner, Uranium One’s Honeymoon project in South Australia. More recently, a Japanese consortium, including Toshiba Corp, the Japan Bank for International Cooperation and the Tokoyo Electric Power Company Inc, entered into a long-term agreement to a 19.95 per cent interest in Uranium One for US$270m. In addition to its Canadian and Australian assets, Uranium One is active in Kazakhstan, thanks to a 70 per cent stake in the Adkala mine and the South Inkai Uranium project, along with a 30 per cent stake in the the Kharasan project. Along with a sizable holding in the Canadian uranium miner, the consortium will hold the right to purchase up to 20 per cent of Uranium One’s output from 2014.

Rio Tinto’s current strategy of selling off non-essential assets has sparked rumours that Japanese companies are considering purchasing its 68 per cent stake in Energy Resources Australia, which owns the Ranger Mine, which is second largest uranium project in Australia and is responsible for almost 11 per cent of the entire world’s uranium output.

In addition to the more established players, there is the Middle-East to consider. While all bets are off with regard to whether or not Iran’s Bushehr plant will ever see the light of day, it is clear that many countries in the region are increasingly looking to nuclear energy, due to a combination of rocketing demand for power and the growing realisation that nuclear reactors could potentially free up more oil for export. The UAE, Egypt and Jordan are particularly interesting, given the former’s colossal deal earlier this year with KEPCO and the fact that Jordan has the 11th largest uranium reserves in the world (some two per cent of total global resources), according to its atomic energy commission (JAEC). Of this figure, some 64,880t is thought to be located in the country’s central region at a depth of 0.5-3m.

As far as the overall picture is concerned, the IEA is expecting the world’s nuclear fleet to grow from the 371GW seen in 2007 to 410GW in 2015 and 475GW by 2030. Assuming no radical advances in technology, that translates to roughly 4.5GW of new capacity being added a year and a 28 per cent increase in both capacity and annual uranium demand.

One Response

Leave a Reply

Make sure you enter the * required information where indicated.

You must be logged in to post a comment.

Click here to read the Q4 2011 Issue of Industrial Fuels & Power

Click here to read the Q4 2011 Issue of Industrial Fuels & Power